Financial Tools by Lady J Speaks

Relay Bank: The Better Choice for Business Owners Over Traditional Banks

Why Traditional Banks Fall Short for Business Owners and How Relay Bank Provides a Superior Alternative

Dealing with processes like opening accounts applying for loans or making major changes often requires a lot of paperwork and visits, to the bank in person. This can eat up time for business owners. For instance, a tech startup might lose out on focusing on product development and attracting customers due to these time consuming banking procedures.

Traditional banks tend to fall short when it comes to offering cutting edge tools that could assist businesses in managing cash flow planning for taxes or automating savings. Without access to tools, businesses might struggle with optimizing their strategies. Take the case of a graphic designer, who may find it tough to set up automated savings or handle cash flows without the appropriate banking tools.

Although traditional banks have security measures, in place, they may not always be quick enough to adopt the security technology amidst the evolving cyber threats landscape compared to fintech companies that prioritize innovation. This delay could expose businesses to cyber attacks and fraud.

Free Banking Services

Relay Bank stands out by eliminating charges commonly found in banking institutions. Monthly maintenance fees, overdraft fees and transaction fees are all waived, allowing businesses to redirect their resources towards expansion and day, to day operations. This cost effective approach empowers businesses like bakeries to invest in equipment or marketing strategies, directly influencing their progress and profitability.

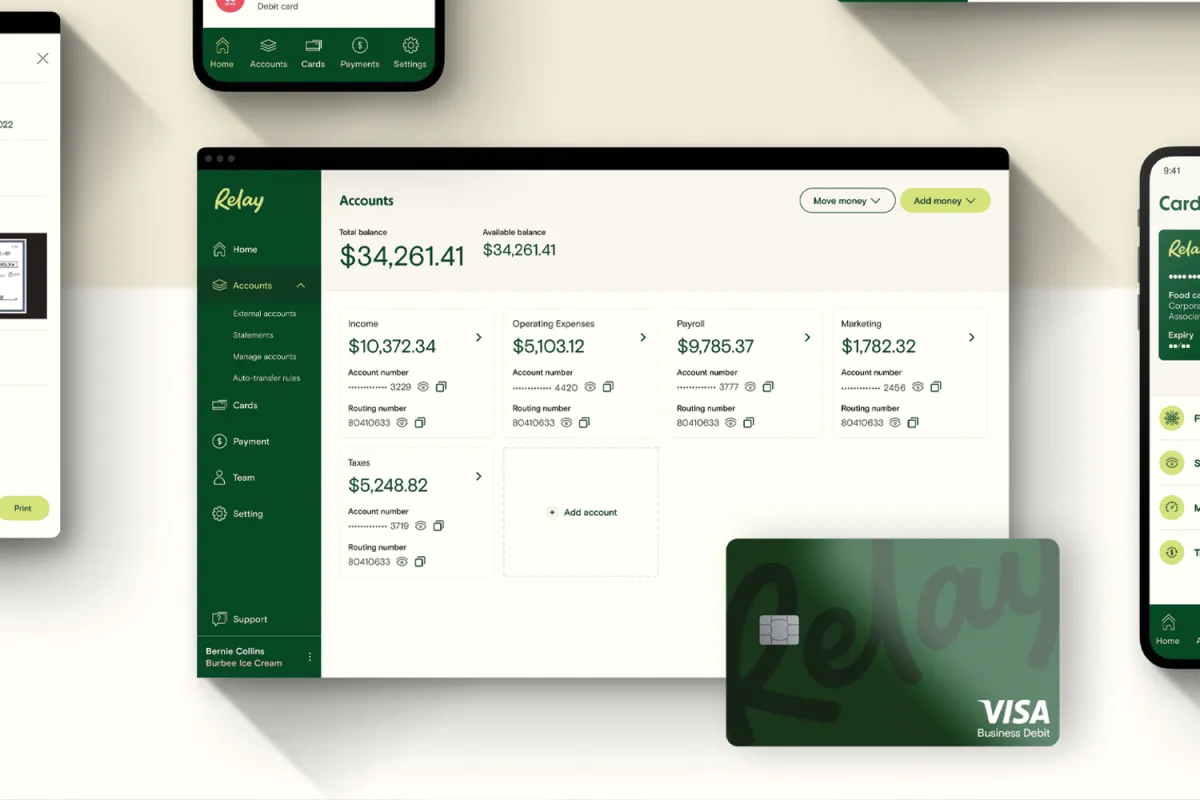

Diverse Account Options for Enhanced Financial Control

Through Relay businesses have the flexibility to open up to 20 checking accounts and 2 savings accounts without incurring charges. This feature enables businesses to efficiently manage funds for purposes enhancing organization and transparency. For example, an event planning company could designate accounts for clients or events, simplifying the tracking of expenses and revenues on an individual basis.

Superior Customer Care Services

Relay ensures round the clock customer assistance for businesses in need of support at any time. Their proficient support team is committed to assisting businesses in reaching their objectives, offering a level of service that's often absent, in conventional banks. A digital marketing agency can depend on this support to promptly address any banking concerns guaranteeing business operations.

A construction company, for instance, can utilize these tools to make sure they always allocate funds, for projects and taxes, preventing any cash flow issues.

Insufficient Integration, with Accounting Software

One common issue with banks is the difficulty in integrating with modern accounting and financial management software. This lack of integration often leads to the need for data entry, which can result in more errors and inefficiencies when it comes to financial reporting. Small business owners who rely on platforms like QuickBooks or Xero may have to spend time reconciling bank statements with their accounting software thereby increasing the chances of making mistakes.

Tedious and Complicated Procedures

The process of opening accounts applying for loans or making changes typically involves a lot of paperwork and requires in person visits to the bank. These lengthy procedures can be a time consuming task for business owners. For instance a tech startup might lose time that could otherwise be used for developing products and acquiring customers due to these banking processes.

Limited Access to Advanced Financial Resources

banks often fall short when it comes to providing financial tools that can assist businesses in managing cash flow planning for taxes or automating savings. Without access to these resources businesses may face challenges in optimizing their strategies. For example a freelance graphic designer might encounter difficulties, in automating savings or handling cash flows without banking tools.

Enhanced Security Measure

Relay implements security measures such as two factor authentication and biometric security to safeguard users accounts. Their security procedures are crafted to keep up with the threats, giving business owners peace of mind. For a consulting firm managing client data these advanced security measures play a role in upholding trust and safeguarding their information.

Case Study: Integration of Relay Bank in a Small Business

Imagine a marketing agency facing financial management challenges due to charges and convoluted processes at a traditional bank. By making the switch to Relay, the agency opens accounts to segregate funds, payroll, and tax reserves. The seamless integration with QuickBooks streamlines their accounting tasks, reducing work significantly. By eliminating fees that impact their budget, they channel the saved funds into marketing initiatives. Implementing the Profit First approach helps them ensure the allocation of profits, improving their well being. Additionally, the agency benefits from the customer service and advanced security measures provided by Relay. Transforming it into more than a bank but also a partner, in their financial prosperity.

In some cases, traditional banks can present challenges that may hinder the progress and expansion of small businesses. Relay Bank stands out by offering no fees a range of account choices top notch customer support, smooth software integration and cutting edge financial resources, as an option. By tackling the hurdles encountered by business proprietors with banking services, Relay enables companies to handle their finances more efficiently and concentrate on advancement. For entrepreneurs seeking to simplify their banking operations, Relay, as a solution is highly recommended.

Click, and we will send you an invitation. Please fill out this form.

Name, Phone, Email, and Business Name— needs to be manually entered in.